The government has extended the Coronavirus Job Retention Scheme until the end of October 2020. On 12 May 2020, the government announced that its furlough scheme would be extended until the end of October 2020. The scheme will continue in its current form without any changes until 31 July 2020. Between 1 August and 31 October 2020, employers will have the flexibility to return staff to work on a part-time basis.

Here are some of the frequently asked questions about the scheme.

Which employers are eligible?

Any employer (of any size) is eligible for the scheme. This includes:

- businesses

- charities

- recruitment agencies (if the agency workers are paid through PAYE)

- public authorities.

To be eligible the employer must have created and started a PAYE payroll scheme on or before 19 March 2020 and have a UK bank account.

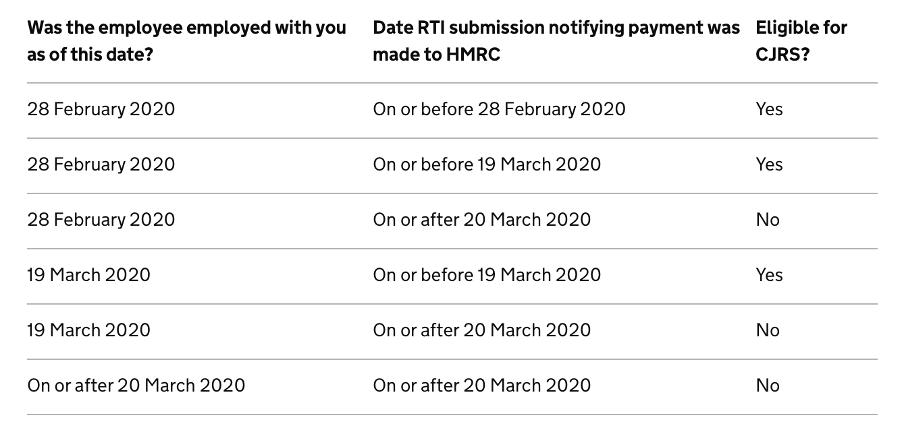

Which employees are eligible under the Coronavirus Job Retention Scheme?

Most of your employees or workers will probably be eligible for you to furlough and claim. The employee must have been paid through your PAYE payroll on or before 19 March 2020. Those who you employed after this date or employed but had not yet paid by this date are not eligible for the scheme. All types of employment and employment contracts are included, including full time, part time, agency workers, flexible workers, and zero-hour contracted workers. Foreign nationals who work for you are eligible too.

Employees on fixed-term contracts are also eligible. If their contract ends during the furlough period you can either extend it, as you might in any other circumstance, or end it, at which point you will not be able to furlough and claim for them.

If you made employees redundant after 19 March 2020, or they resigned, they are eligible for the scheme. But you will need to update your payroll to remove their termination and send an updated Full Payment Submission to HMRC. You can re-employ them, furlough them, and claim their wages.

How much can I claim under the Coronavirus Job Retention Scheme?

You can claim up to 80% of a furloughed employee’s gross salary per month which is before tax, employee NI and other statutory deductions such as student loan repayments are deducted. This is up to a monthly ceiling of £2,500 per employee, even if they have more than one job with you. You can also work out 80% of your employees’ wages to claim through the Coronavirus Job Retention Scheme

There is no limit on the number of employees you can furlough and claim for under the scheme.

How to claim?

You’ll need the Government Gateway user ID and password you got when you registered for PAYE online. And you’ll need to gather quite a few details before making the application.

- to be registered for PAYE online

- your UK bank account number and sort code (only provide bank account details where a BACS payment can be accepted)

- the billing address on your bank account (this is the address on your bank statements)

- your employer PAYE scheme reference number

- the number of employees being furloughed

- each employee’s National Insurance number (if you have one or more without a National Insurance number please contact HMRC)

- each employee’s payroll or employee number (optional)

- the start date and end date of the claim

- the full amount you’re claiming for including employer National Insurance contributions and employer minimum pension contributions

- your phone number

- contact name

- your name (or the employer’s name if you’re an agent)

- your Corporation Tax unique taxpayer reference

- your Self Assessment unique taxpayer reference

- your company registration number

If you’re claiming for 100 or more furloughed employees, you’ll need to upload a file containing the following for each employee:

- full name

- National Insurance number

- payroll number (optional)

- furlough start date

- furlough end date (if known)

- full amount claimed

- provide only the employee information requested here – if you provide more or less information than required, you may risk delaying your payment and/or be asked to provide the information again

- submit one line per employee for the whole period

- do not break up the calculation into multiple periods within the claim

- do not split data by contract type

- upload your file as an .xls, .xlsx, .csv or .ods

For more information you can read a full guidance on government website. Claim for wages through the Coronavirus Job Retention Scheme . If you have any enquires, need help or want to apply for a Tier 2 Sponsor licence, please contact us. UK Visa Partners is always with you.